Dec 1, 2025

Five Ways to Value a Business (Without the MBA Jargon)

Five Ways to Value a Business (Without the MBA Jargon)

Ray Smith

Lead Research Analyst

Ask five accountants what your business is worth and you'll get five different answers. That's not because they're bad at math—it's because there are genuinely different ways to slice this pie. Each method looks at your business from a different angle, and understanding all five gives you a much clearer picture than relying on just one.

That's exactly why we built Your Exit Value to show all five methods side-by-side. No more guessing which number to trust. Let's break these down in plain English.

EBITDA: What Your Business Earns Before the Accounting Stuff

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. I know—mouthful. But the concept is simple: it's how much cash your business generates from actual operations, stripped of financing decisions and accounting write-offs.

Why do buyers care? Because interest depends on how you financed the business, taxes vary by structure and location, and depreciation is just paper—it doesn't affect cash in the register. EBITDA cuts through all that noise to show operational performance.

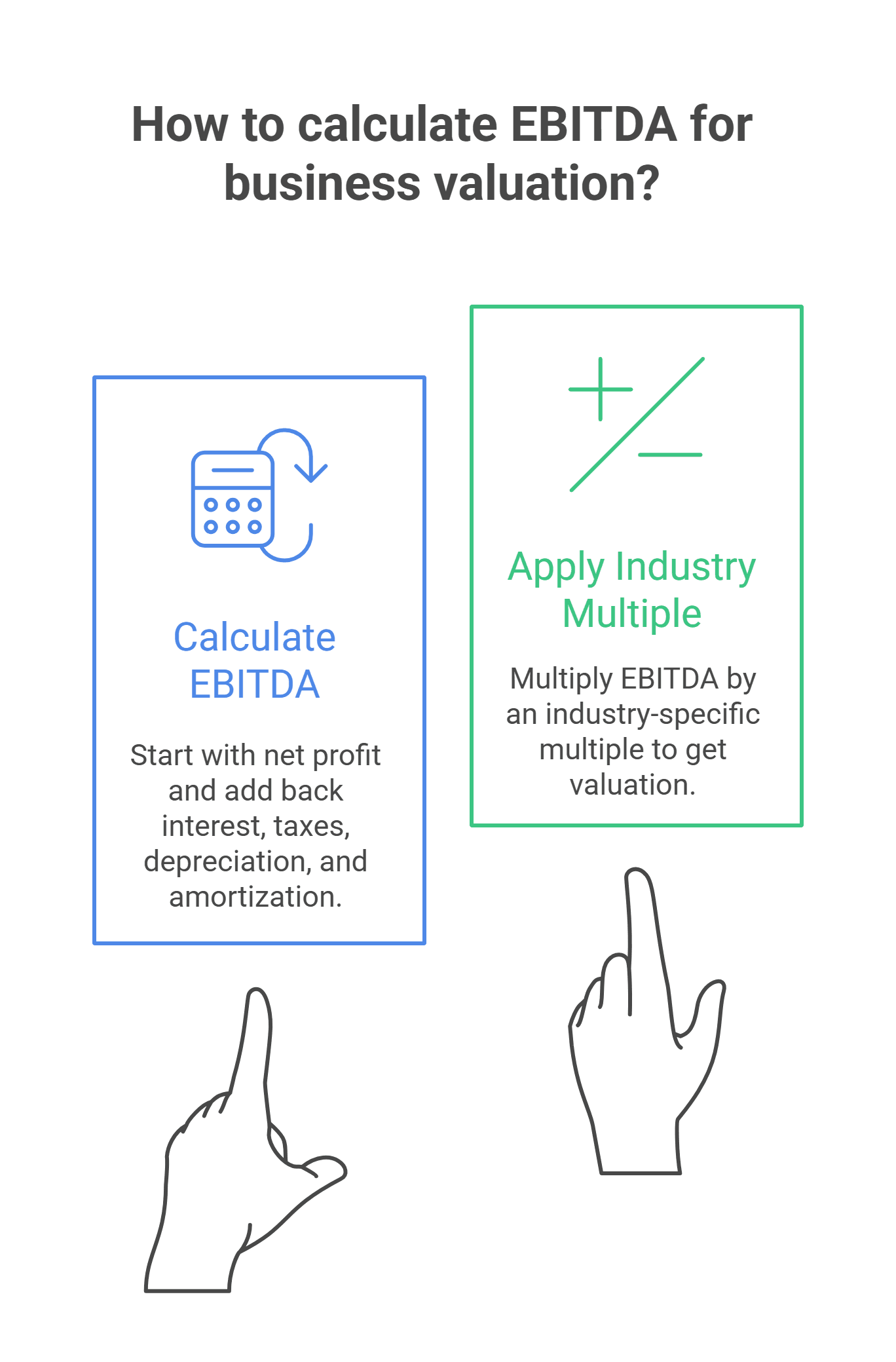

How to calculate it: Start with your net profit. Add back interest expense, income taxes, depreciation, and amortization. That's your EBITDA.

Example: Your business shows $80,000 net profit. You paid $10,000 in interest, $25,000 in taxes, and recorded $15,000 in depreciation. Your EBITDA is $80,000 + $10,000 + $25,000 + $15,000 = $130,000.

To get a valuation, multiply EBITDA by an industry multiple. Your Exit Value pulls these multiples from real transaction data for your specific NAICS code—not generic rules of thumb. A $130,000 EBITDA with a 3x multiple means a $390,000 valuation.

SDE: The Owner-Operator's Number

SDE stands for Seller's Discretionary Earnings. This one's built specifically for small businesses where the owner is heavily involved. It answers the question: how much money could a new owner pull out of this business if they stepped into your shoes?

SDE takes EBITDA and adds back the owner's salary plus any personal expenses running through the business. That car payment on the company books? Added back. Health insurance for your family? Added back. The logic is simple—a new owner gets to decide how to pay themselves and what perks to keep.

How to calculate it: Take your EBITDA, add back your full owner's compensation (salary, bonuses, retirement contributions), and add any personal expenses the business covers.

Example: Your EBITDA is $130,000. You pay yourself $70,000 salary and run $12,000 in personal expenses through the business. Your SDE is $130,000 + $70,000 + $12,000 = $212,000.

Your Exit Value makes these adjustments transparent—you'll see exactly how owner compensation and discretionary items impact your numbers, so there's no confusion during due diligence. SDE multiples for small businesses vary wildly. Please use Your Exit Value to find your SDE multiple for your specific industry.

Revenue Multiple: Quick and Dirty

This is the simplest approach—just multiply your annual revenue by a factor. It's fast, easy to understand, and useful for ballpark comparisons. The downside? It completely ignores profitability.

A company doing $1 million in revenue with 5% margins is worth far less than one doing $800,000 with 25% margins. Revenue multiples don't see that difference, which is why serious buyers use this as a sanity check rather than a final answer.

How to calculate it: Multiply your annual gross revenue by an industry-specific factor (typically 0.25x to 1x for service businesses, higher for tech or recurring-revenue models).

Example: Your company does $600,000 in annual revenue. Using a 0.5x multiple, that's a $300,000 valuation. Simple math, rough estimate.

Asset-Based: What You Own Minus What You Owe

This method adds up everything the business owns—equipment, vehicles, inventory, real estate, cash—and subtracts all debts and liabilities. What's left is the asset-based value.

Think of it as the floor value: if you liquidated everything tomorrow, this is roughly what you'd walk away with. It's most relevant for businesses with significant hard assets or those being sold in distress situations.

How to calculate it: List all assets at fair market value (not what you paid—what they'd sell for today). Subtract all liabilities including loans, payables, and obligations.

Example: You have three trucks worth $90,000 total, $40,000 in equipment, $15,000 inventory, and $20,000 cash. That's $165,000 in assets. You owe $35,000 on a loan and $10,000 to vendors. Asset-based value: $165,000 - $45,000 = $120,000.

DCF: The Crystal Ball Method

Discounted Cash Flow analysis asks: what are all the future profits of this business worth in today's dollars? It's the most sophisticated method—and the most sensitive to assumptions.

The core idea is that money today is worth more than money later. If someone offered you $100,000 today or $100,000 five years from now, you'd take it today. DCF applies that logic to future business earnings, "discounting" them back to present value.

How to calculate it: Project your annual cash flows for the next 5-10 years. Choose a discount rate (typically 15-25% for small businesses to account for risk). Calculate what each year's cash flow is worth today, then add them up.

Example: You project $100,000 annual cash flow for five years. Using a 20% discount rate, year one's cash flow is worth $83,333 today, year two is worth $69,444, and so on. Add those up plus a terminal value, and you've got your DCF valuation.

So Which One Should You Use?

All of them. Seriously. Each method highlights something different. EBITDA shows operational efficiency. SDE reveals true owner benefit. Revenue gives you a quick market comparison. Asset-based sets your floor. DCF captures future potential.

When the numbers cluster together, you've got confidence in your valuation range. When they're wildly different, that tells you something too—maybe your business has great revenue but thin margins, or strong profits but few hard assets.

Your Exit Value runs all five calculations automatically and displays them on a single dashboard. You'll also see how your valuation has changed year-over-year, so you know whether you're building value or losing ground. When you're ready to share generate a professional Broker Opinion of Value report with one click.

The goal isn't to pick the highest number and run with it. The goal is to understand your business potential value from every angle so you can understand your potential value from knowledge, not hope.

Get Started With Your Exit Value

Know your number. Maximize your businesses value

We've built solutions for every stage of your businesses journey, from exit planning, to business owner retirement analysis, to presale optimization. Get the clarity you need in minutes, not months