The Complete Guide to Exit Planning Assessments: 9 Critical Areas Every Business Owner Must Evaluate

If you're a business owner thinking about your eventual exit—whether that's in two years or twenty—you've probably wondered: "How do I know if my business is actually ready for a successful transition?" It's a question that keeps many entrepreneurs up at night, and for good reason. The difference between a well-prepared exit and a rushed one can literally be millions of dollars in value.

That's where comprehensive exit planning assessments come in. These aren't just generic business evaluations—they're specifically designed to identify the strengths, weaknesses, and opportunities that will make or break your exit strategy. Today, let's dive deep into the nine critical assessment areas that YourExitValue.com uses to help business owners maximize their exit value and ensure smooth transitions.

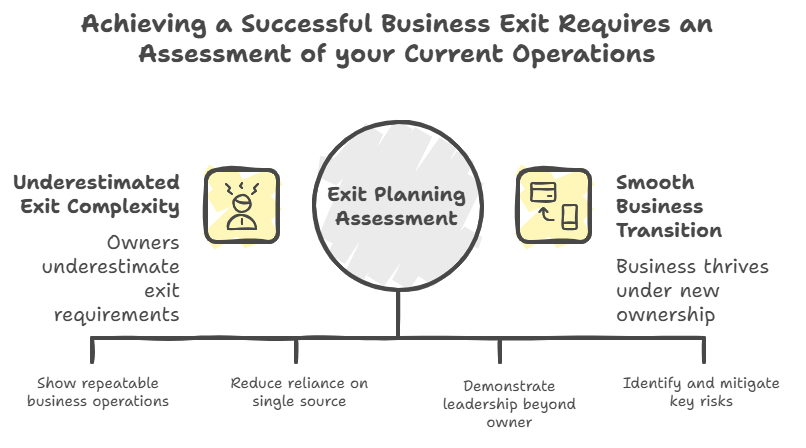

Why Exit Planning Assessments Matter More Than You Think

Before we jump into the specifics, let's be honest about something: most business owners drastically underestimate what goes into a successful exit. You might have built an incredibly profitable company, but profitability alone doesn't guarantee a premium valuation or a smooth transition to new ownership. Buyers—whether they're strategic acquirers, private equity firms, or even family members—are looking for businesses that can thrive without the current owner. They want to see documented processes, diversified revenue streams, strong management teams, and minimal risk factors. An exit planning assessment helps you see your business through their eyes and identify exactly what needs to be addressed.

Let's explore each of the nine critical assessment areas:

1. Industry-Specific Operational Excellence: The Operational Excellence Certification™

Every industry has its own set of best practices, regulatory requirements, and operational standards that separate the leaders from the laggards. This assessment area focuses on how well your business stacks up against these industry-specific benchmarks Think about it this way: if you're running a manufacturing company, your operational excellence looks very different from a software company or a healthcare practice. A manufacturer might be evaluated on lean production principles, safety protocols, and supply chain efficiency. A software company, on the other hand, would be assessed on development methodologies, code quality standards, and deployment processes.

This section evaluates your operations against sector-specific excellence measures, including any industry certifications you might have (or should have). It looks at regulatory compliance—which is absolutely critical in industries like healthcare, finance, or food services—and examines whether your operational processes would meet the standards expected by sophisticated buyers in your industry.

What makes this particularly valuable is that it's customized for your specific sector. The questions and benchmarks adapt based on your industry, ensuring you're not being evaluated against generic business standards but against the specific operational requirements that buyers in your space will expect to see.

2. Industry-Specific Financial Metrics: The Sector Performance Metrics™

Just as operational standards vary by industry, so do the financial metrics that matter most. This assessment goes beyond basic profit and loss statements to examine the financial ratios and performance indicators that are most relevant to your specific sector.For example, if you're in retail, inventory turnover ratios and same-store sales growth might be critical metrics. If you're running a SaaS business, monthly recurring revenue, customer acquisition costs, and lifetime value ratios take center stage. A professional services firm might be evaluated primarily on utilization rates and revenue per employee.

This section examines industry-specific financial reporting requirements—some sectors have unique accounting standards or reporting obligations that buyers expect to see properly managed. It also looks at margin expectations that are typical for your industry. What's considered a healthy margin in one sector might be completely inadequate in another.

The assessment also covers working capital considerations that are unique to your industry. Different sectors have vastly different working capital requirements and cash flow patterns, and this evaluation ensures your business is optimized for your specific industry's financial realities.

3. Financial Performance & Health: The Financial Foundation Analysis™

Now we get to the meat and potatoes of what many consider the most important aspect of any business evaluation—the overall financial health and performance. This comprehensive analysis covers twelve critical areas that determine whether your business has the financial foundation necessary to support a premium valuation. Profitability consistency is one of the first things buyers examine. It's not enough to have had a couple of great years if they're surrounded by mediocre or volatile performance. This assessment looks at your profit trends over time and evaluates whether your profitability is sustainable and predictable. Revenue growth trajectory is equally important. Buyers want to see businesses that are growing, but they also want to understand the sustainability of that growth. Is it driven by one-time events, or do you have underlying drivers that suggest continued expansion?

Profit margins get scrutinized heavily, particularly in comparison to industry standards. The assessment examines both gross and net margins and looks at margin trends over time. Are your margins improving, stable, or declining? What's driving those changes? Cash flow predictability might be even more important than absolute profitability levels. Buyers need to understand your cash conversion cycles, seasonal variations, and the reliability of your cash generation. A business with predictable cash flows is worth significantly more than one with volatile cash patterns, even if the average profitability is similar.

The quality of your financial records is also critical. This includes everything from the sophistication of your accounting systems to the timeliness and accuracy of your financial reporting. Many smaller businesses have adequate bookkeeping for operational purposes but lack the financial rigor that buyers expect. Customer concentration risk is a huge factor that can make or break a deal. If a significant portion of your revenue comes from just a few customers, that represents a major risk to buyers. This assessment examines your customer diversification and identifies concentration issues that need to be addressed. Working capital management affects both your current cash flows and your attractiveness to buyers. Efficient working capital management frees up cash and demonstrates operational sophistication. The assessment looks at your accounts receivable collection, inventory management, and accounts payable optimization.

Finally, tax compliance status might seem mundane, but it's absolutely critical. Any issues with tax compliance can delay or derail a transaction. The assessment ensures all tax obligations are current and properly documented.

4. Market Position & Sales Infrastructure: The Market Position Assessment™

Your market position and sales capabilities often determine the multiple that buyers are willing to pay for your business. This assessment examines twelve key areas that collectively determine your competitive strength and market value. Brand reputation and recognition in your market space can significantly impact valuation. Strong brands command premium prices and have more predictable customer loyalty. This evaluation looks at your brand strength, market recognition, and reputation among customers and competitors.

Market growth trajectory matters enormously to buyers. Even a moderately profitable business in a rapidly growing market might be more attractive than a highly profitable business in a declining sector. The assessment examines your market's growth prospects and your positioning within that growth. Business differentiation is what separates premium valuations from commodity pricing. What makes your business unique? Why do customers choose you over competitors? This evaluation identifies your true competitive advantages and assesses how sustainable they are.

Barriers to entry in your market affect how defensible your market position is. High barriers to entry mean less competitive pressure and more sustainable profitability. The assessment examines regulatory barriers, capital requirements, expertise needs, and other factors that protect your market position. Exclusive arrangements, whether with suppliers, distributors, or customers, can create significant competitive advantages. These might include exclusive territories, preferred supplier agreements, or long-term contracts that provide revenue predictability.

Customer satisfaction metrics provide insight into your competitive strength and future growth prospects. Highly satisfied customers are more likely to increase their business with you, refer new customers, and remain loyal even when competitors target them. Sales process documentation might seem like an operational issue, but it's really about scalability and transferability. Well-documented sales processes can be executed by new team members and optimized systematically. This assessment examines how well your sales processes are defined, documented, and consistently executed.

5. Operational Excellence & Systems: The Operational Systems Maturity™

This assessment area focuses on the sophistication and transferability of your operational systems. Nine key questions examine whether your operations can scale effectively and transfer smoothly to new ownership—two critical factors for buyers. Process documentation is foundational to operational excellence. Many businesses run efficiently because the owner or key employees have years of experience and institutional knowledge. But what happens when they're no longer around? Well-documented processes ensure that operational knowledge is captured and transferable.

Management systems and operational efficiency are about more than just getting the work done—they're about doing it in a way that's systematic, measurable, and improvable. This includes everything from production planning systems to quality management processes. Knowledge capture goes beyond process documentation to include the intellectual capital that makes your business successful. This might include customer insights, supplier relationships, technical expertise, or market knowledge that gives you competitive advantages.

Quality control systems are critical for maintaining consistency and meeting customer expectations. Buyers want to see systematic approaches to quality management that don't depend on individual heroics or constant owner oversight. Vendor relationships can be significant business assets, particularly if you have favorable terms, reliable suppliers, or hard-to-replace partnerships. The assessment examines these relationships and their transferability to new ownership.

Inventory management affects both working capital efficiency and operational reliability. Sophisticated inventory management systems and processes demonstrate operational maturity and free up cash that would otherwise be tied up in excess stock.

6. Risk Management & Business Continuity: The Enterprise Risk Shield™

Risk management might not be the most exciting topic, but it's absolutely critical for maintaining business value and ensuring successful transitions. This comprehensive assessment examines your business's resilience and identifies vulnerabilities that could impact value or derail transactions. Insurance coverage is the foundation of risk management, but many businesses are either under-insured or have coverage gaps that create significant exposures. The assessment examines whether your insurance adequately protects against the risks specific to your business and industry.

Legal compliance is non-negotiable in any transaction. Compliance issues can delay deals, reduce valuations, or even kill transactions entirely. This evaluation covers regulatory compliance across all applicable areas of your business. Business continuity planning addresses what happens when things go wrong. Whether it's a natural disaster, cyber attack, or other disruption, buyers want to know that your business can continue operating. This includes disaster recovery plans, backup systems, and alternative operational procedures. Key person dependency is one of the biggest risks in many businesses. If your business can't function without you or another key individual, that represents a major risk to buyers. The assessment identifies these dependencies and evaluates strategies for reducing them.

Intellectual property protection can be a major asset or a significant vulnerability. Whether it's patents, trademarks, trade secrets, or proprietary processes, the assessment examines how well your intellectual property is protected and documented.

7. Technology Infrastructure & Cybersecurity: The Digital Infrastructure Readiness™

In today's business environment, technology infrastructure and cybersecurity aren't optional—they're fundamental requirements for business success and transferability. This assessment examines whether your technological foundation is modern, secure, and capable of supporting business growth. Digital infrastructure robustness looks at the underlying technology systems that support your business operations. Are your systems reliable, scalable, and up-to-date? Can they handle increased transaction volumes or business growth? Outdated or unreliable technology infrastructure can be a major obstacle to business growth and transition.

Security protocols and cybersecurity posture are increasingly critical. Cyber threats are real and growing, and buyers are acutely aware of the risks. A major security breach can devastate a business's value and reputation. The assessment examines your cybersecurity measures, data protection protocols, and vulnerability management. Data protection and privacy compliance have become major concerns, particularly with regulations like GDPR and various state privacy laws. The assessment looks at how well your business handles customer data and complies with relevant privacy regulations.

Technology transferability is also important. Are your systems documented and manageable by new ownership? Are you dependent on proprietary systems or specialized knowledge that might be difficult to transfer?

8. Facilities & Real Estate: The Physical Asset Optimization™

Your physical assets and facilities can significantly impact your business's value and operational efficiency. This assessment examines how well your physical infrastructure supports your business and adds value for potential buyers. The condition and efficiency of your facilities affects both operational costs and buyer perceptions. Well-maintained, efficient facilities demonstrate good management and reduce the capital investment that new owners might need to make.

Strategic value of your physical assets goes beyond their basic utility. Location advantages, specialized facilities, or unique physical capabilities can create competitive advantages and increase business value. Real estate ownership versus leasing decisions affect both your balance sheet and your operational flexibility. The assessment examines whether your current real estate strategy optimizes both cost and strategic value.

Asset utilization and optimization looks at how efficiently you're using your physical assets. Underutilized facilities represent both cost inefficiencies and potential opportunities for new owners.

9. Human Capital & Organizational Strength: The Human Capital Excellence™

Perhaps no factor is more critical to business success and transferability than the quality and depth of your human capital. This assessment examines whether your organization has the leadership and talent foundation necessary for successful ownership transition and continued growth. Management depth is crucial for business continuity and growth. Buyers want to see strong management teams that can operate the business effectively without constant owner involvement. This includes both current management capabilities and succession planning for key positions.

Employee retention indicates both organizational health and operational stability. High turnover is expensive and disruptive, while strong retention suggests good management, competitive compensation, and positive workplace culture. Succession planning goes beyond just identifying potential replacements for key roles. It includes development programs, knowledge transfer processes, and systematic approaches to building organizational capability.

Compensation structures and performance management systems demonstrate organizational sophistication and help ensure that you can attract and retain quality talent. Competitive compensation packages and fair performance management create stable, motivated teams. Cultural strength indicators might seem soft, but organizational culture has real business impact. Strong cultures improve employee engagement, customer satisfaction, and business performance. They also make businesses more attractive to buyers who want to maintain continuity.

The Bottom Line: Your Exit Success Depends on Preparation

These nine assessment areas work together to create a comprehensive picture of your business's readiness for a successful exit. No single area alone determines success or failure, but weaknesses in any area can significantly impact your business value or the likelihood of a successful transition. The key insight is that exit planning isn't something you do in the year before you want to sell—it's an ongoing process of building business value and reducing risks. Many of the improvements identified through these assessments take months or years to implement properly.

By systematically evaluating and improving your business across all these dimensions, you're not just preparing for an eventual exit—you're building a stronger, more valuable, and more enjoyable business to own and operate. That's the real power of comprehensive exit planning assessments: they help you build the business you always wanted while maximizing your eventual exit value.

Whether your exit is planned for next year or next decade, understanding how your business measures up in these critical areas is the first step toward achieving the exit success you deserve.